Many in Congress are pledged never to raise taxes. They say we must, in fact, further cut the “tax wedge”, the difference between an employer’s cost for a worker and the employee’s after-tax reward. The tax wedge grows when taxes go up so it costs more to employ workers at a given after-tax wage. If taxes go down, it costs less to employ workers at the same after-tax wage. That means to cut unemployment we should cut taxes, right?

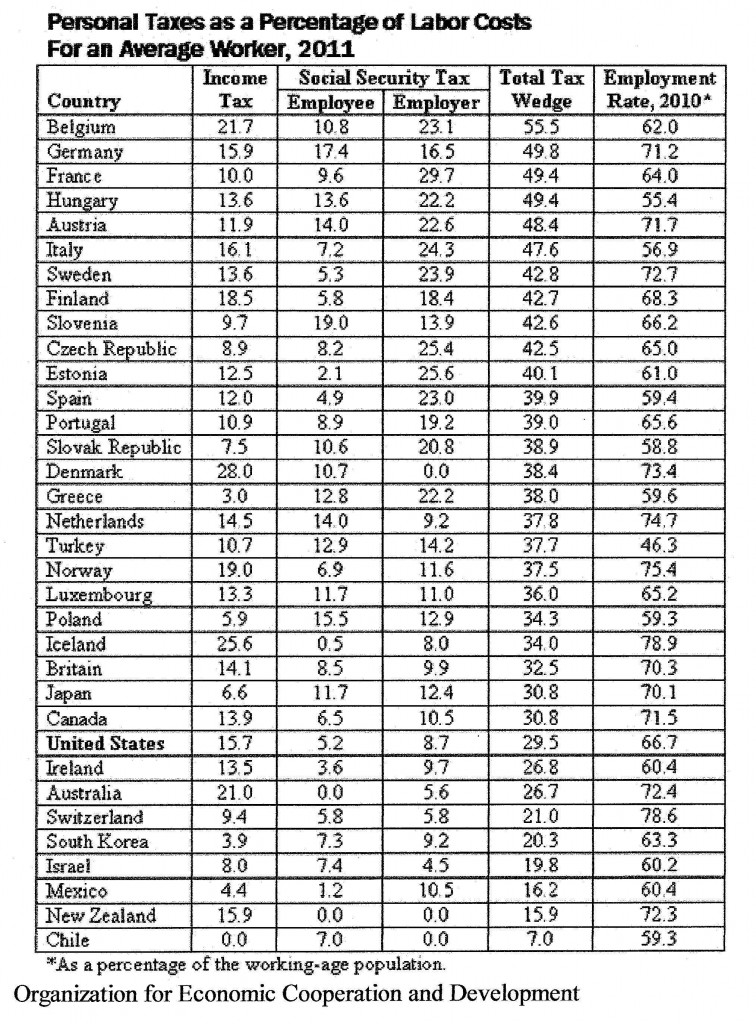

New data from the Organization for Economic Cooperation and Development (OECD) show there is in fact no correlation between size of tax wedge and rate of employment.

The USA is a low-tax country with a tax wedge of 29.5%. Three-quarters of OECD countries have a larger tax wedge on average workers. The data in the last column is workers employed as a % of the working-age population, a better indicator of labor market health than unemployment rate, which fluctuates for many reasons and is counted in many ways.

Key take-aways: Almost half the countries with a bigger tax wedge employ a larger percentage of their working-age populations than the USA. More than half of those with a smaller tax wedge have lower employment ratios.

Hat-tip to Bruce Bartlett who held senior policy roles in the Reagan and George H.W. Bush administrations and served on the staffs of Representatives Jack Kemp and Ron Paul. He concludes http://economix.blogs.nytimes.com/2012/05/01/taxes-and-employment/ by saying: “There is simply no evidence that cutting taxes at the present time will do anything to raise employment.”

I was tempted to title this “Tax Bullshit” because it addresses an argument about taxes that sounds logical but isn’t. Then came a blinding light. What if we could tax bullshit like we do cigarettes? Cigarettes harm our health, so does bullshit. We suffer less from others’ cigarette smoke theses days, how about if we could suffer less from others’ bullshit opinions masquerading as facts and logic? But the light faded. We need a simpler tax code, not additional embellishment of problematic incentives and disincentives.