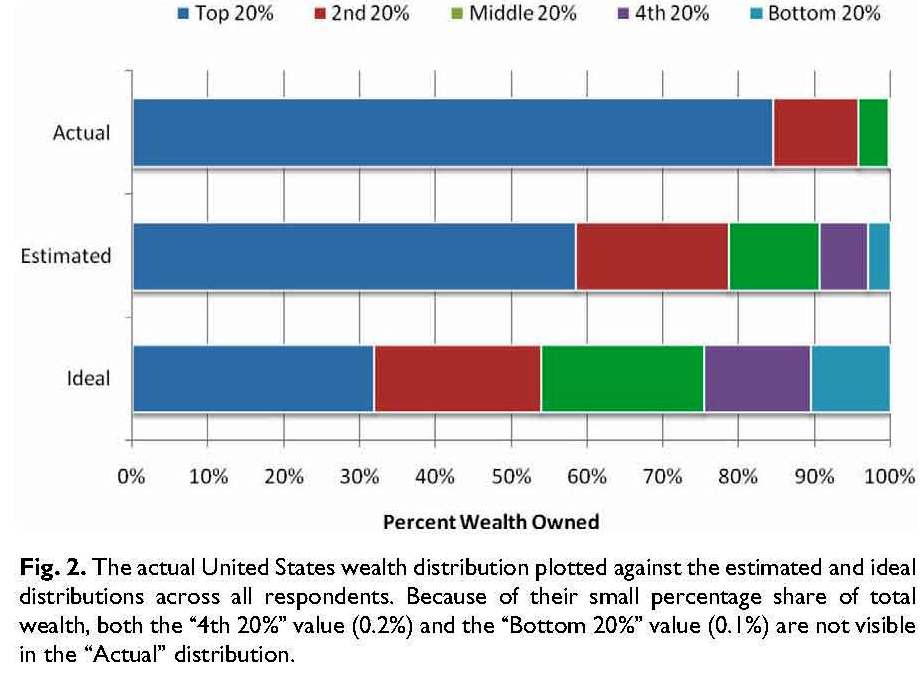

More than nine in ten Americans want the top 20% to have about one third (32%) of society’s wealth not 84% as they do now. Is that a good thing to want? Would a more equal distribution be bad for growth? Is the current distribution a problem, anyway?

The instinct of those who think the middle 60% should have close to 60% of society’s wealth is good. When the middle class has only a quarter of that share and it is shrinking, they cannot drive enough consumption of basic goods. That’s a big problem because 70% of our GDP is consumer spending.

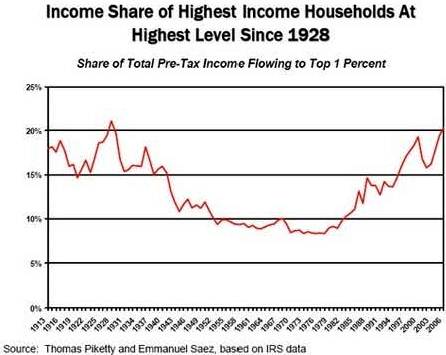

Unequal wealth distribution results from unequal income income distribution. The opportunity to become more wealthy is important for economic growth. Is there an income distribution that maximizes growth? Is there a point where the wealthy have too much? I have found no definitive answer, but there has been a high correlation between extreme inequality and economic crises.

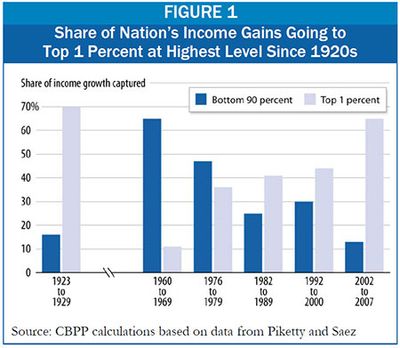

Is that correlation just happenstance? Probably not. Our economy was strong in the 1950s and 60s when everyone shared in income growth. It collapsed in the 1920s and 2000s when an extreme share of income growth went to the top 1% and a tiny percentage went to the bottom 90%.

The reason seems to be that when the middle-class falls behind to the extent it did in the 1920s and 2000s, governments promote easy credit. Both times, the middle class borrowed heavily as their earnings stagnated and the wealthy got more. In the 1920s, it was farm credit, installment loans and home mortgages – mortgage debt was almost three times higher in 1929 than in 1920. In the 2000s, it was home buyers putting no money down and investment banks lending $30 for each $1 they held.

When easy credit drives down the yield on traditional investments, investors become speculators. The wealthy piled into stocks in the 1920s driving the Dow from 64 in 1921 to 381 in 1929. In the 2000s the bubble was in seemingly safe but disastrous mortgage-backed securities.

The influential 1975 book, Equality and Efficiency: The Big Tradeoff, theorized that more equal distribution of incomes reduces the incentive to work and administrative costs waste some of what is taken from the rich for redistribution. Contemporary research summarized in this 2011 International Monetary Fund paper, Equality and Efficiency, suggests the opposite – equality is an important ingredient in promoting growth, and inequality in less sustained growth.

Income distribution is strongly associated with the duration of growth spells along with well-established growth factors such as quality of political institutions and trade openness. The chart below, which covers 1950 to 2006, shows the increase in expected duration of a growth spell for a given increase in several factors, keeping the others constant. Some inequality is necessary in a market economy but too much results in financial crisis.

Very few people saw what had gone wrong with the economy in the 1930s. One who did was not an economist but an extremely successful businessman. Marriner Eccles saw how his customers were reacting to the economic crisis and made recommendations to a Senate Finance Committee just before Roosevelt was sworn in as President in 1933. FDR’s actions that year were much like his predecessor Hoover’s and equally ineffective. Then he made Eccles Chairman of the Fed. He remained there until 1948 and later summarized his observations, quoted in The Great Recession.

Eccles wrote (paraphrased for simplicity): “mass production must be accompanied by mass consumption. That implies a distribution of income sufficient to provide buying power for the economy’s products. Instead, a giant suction pump had by 1929-1930 transferred purchasing power from mass consumers to investors. Investments were not made, however, because there was insufficient demand. Income was concentrated in fewer and fewer hands. Consumers could stay in the game only by borrowing. When their credit ran out, the game stopped.”

In other words, too much income going to the top chokes the life out of the economy. Now, for a variety of reasons, the same thing has happened again. How does it happen?

Extreme concentration of wealth starts slowly, builds unobtrusively, gains first influence then power and if unchecked, results in extreme corruption. As President Wilson wrote in 1913: “If there are men in this country big enough to own the government of the United States, they are going to own it”.

Boushey and Hersh’s comprehensive 2012 review of research into what makes an economy grow or stop growing, Income Inequality and the Strength of Our Economy, comes to the same conclusion. Extreme concentration of wealth corrupts the political and economic institutions that underlie economic success. Acemoglu and Robinson offer compelling evidence of it from 15 years of original research which they summarize here.

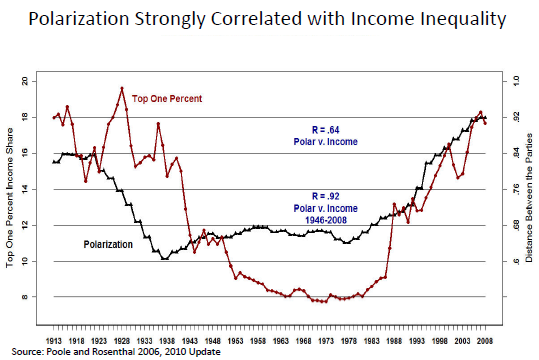

Extreme income inequality leads to political instability. That not only discourages investment, it also makes it harder to raise taxes or cut public spending to avoid a debt crisis, and it curtails poor people’s access to education. Increasingly extreme inequality makes government ever more polarized as demonstrated by Poole’s research summarized in: Ideological Polarization and Income Inequality and illustrated in the following chart:

Income inequality in the USA is not on a par with other advanced economies, members of the OECD, but with Bulgaria, Iran and Uganda.

How can we re-establish a more equal distribution of income and the associated economic growth? I’ve posted about changes to our financial (too-big-to-fail banks), healthcare and defense sectors and our tax system, but how can we get any such changes?

It’s time to explore governance. Every society is ruled by an elite. Our elite is elected to represent the interests of all. It does that at different times to a greater or lesser extent, substantially lesser at this time. What factors make the difference? What changes to our government should we consider?

EricN wrote:

Wealth is mostly determined by ownership of assets, not cash on hand. Most people do not earn enough cash to buy things like beach front property, large houses, stocks and businesses. That has always been the case, so what’s different now?

We have an out of control financial sector that initially was created to facilitate business transactions and provide a way for people to invest money they saved. It no longer does that. The financial sector has grown so large that it can only sustain itself by finding ways to skim money from every transaction, thus, having the reverse effect on business transactions.

We have a population that has tripled during my lifetime. This means more people competing for real assets and driving the price to the point it is unfordable for most people to own them. The increase in the price of real assets adds to the wealth of the owners.

The government lies about the rate of inflation so that people don’t get raises and don’t keep up with inflation.

The tax rate is unfair to poor working class people. The tea party claims they pay no taxes; that’s only partially true. They pay the entire portion of the payroll tax, since they don’t earn more than the max. They pay 6% of their salary, on average, to sales taxes, since they spend all of their earnings. They pay phone taxes, gas taxes and on and on. Middle class people pay the highest percentage of the tax since they are in the highest state and federal tax brackets. These earners pay 50% of their income in tax while a hedge fund manager pays 10 – 15% tax and companies like GE pay no tax at all.

We have a mentality on corporate governing boards that CEOs should earn disproportionate salaries when compared to workers.