Who does the Republican tax proposal aim to benefit ? Let’s examine its intentions, then look at an approach that extends some of its features and is progressive.

Clear intent: Give more to the heirs of the very wealthy, e.g., President Trump. The estate tax is eliminated entirely in six years, which greatly benefits the wealthiest 0.2% of the population.

Clear intent: Continue to take less from wealthy hedge fund managers and private equity executives who will continue to be taxed at capital gains rates that are about half the ordinary income tax rate on profits they pay themselves via the carried interest loophole.

Clear intent: Give more to the owners of partnerships, S corporations, and sole proprietorships, which are overwhelmingly owned by rich individuals like President Trump. Income from them that is returned to the companies’ owners is now taxed at the same rates as wages and salaries but it would be taxed at a new 25% rate. The Tax Policy Center (TPC) finds that the top 1% would receive 88% of the benefit with the 400 households with the highest incomes getting an average annual tax cut of $3.7 million.

Clear intent: Give all those with high incomes more by eliminating the alternative minimum tax and raising the threshold for the 39.6% top rate on income (which was 70% in 1980) to $1 million for couples, up from $470,700 today.

Clear expectation with unclear intent: Add at least $1.5 trillion to the federal debt over a decade (many economists think it will be more) by cutting the corporate tax rate from 35% to 20% without raising other taxes. The cost of this debt will grow as interest rates rise so the intent could be to “starve the federal government of revenues, setting the stage for a frontal attack on core social programs such as Social Security and Medicare.”

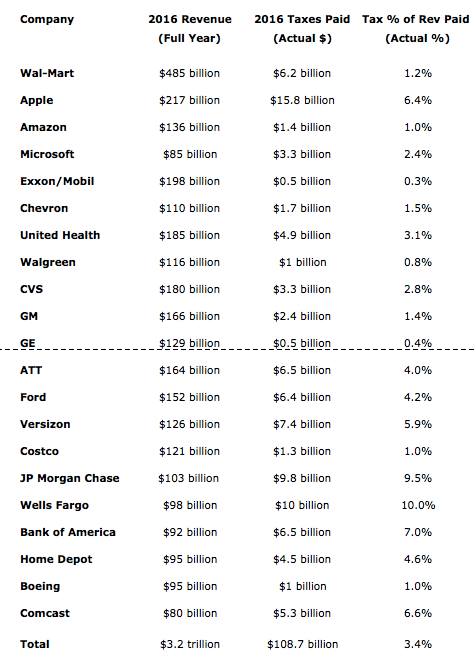

Unclear intent: The corporate tax rate is cut from 35% to 20%, which will save US corporations $2 trillion over the next ten years. The great majority of economists believe shareholders would be the primary beneficiaries but Republicans say employee salaries would rise.

Treasury Secretary Mnuchin claims: “many, many economic studies show that more than 70% of the burden of corporate taxes are passed on to the workers.” Congress’s non-partisan scorekeepers — the Congressional Budget Office and Joint Committee on Taxation — as well as Treasury’s Office of Tax Analysis have all assessed the empirical research as showing that only about a quarter or less of corporate taxes fall on workers, meaning that they would receive a quarter or less of the benefit of corporate tax cuts.

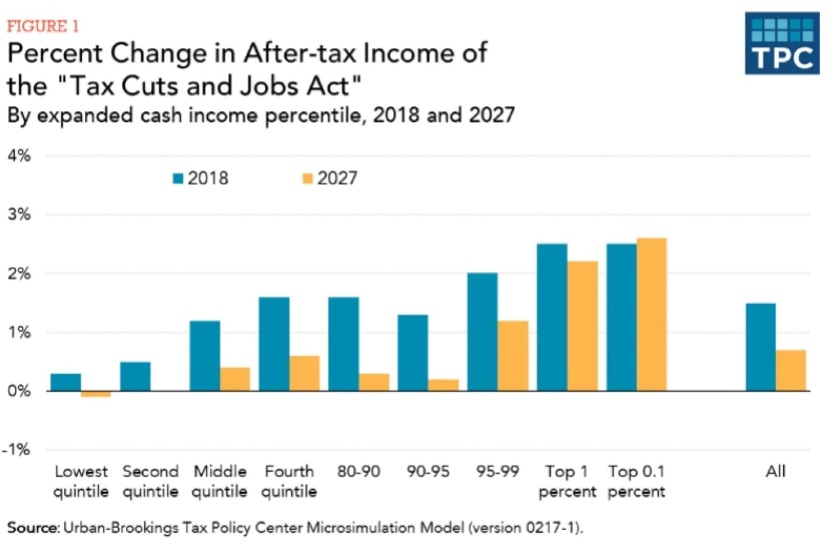

The Tax Policy Center estimates that over a third of the benefit would go to the top 1% and 70% to the top fifth. By 2027, low- and moderate-income families with children would receive little or no tax cuts, and many would see tax increases while 80% of benefits would go to the top 1% of households and after-tax incomes of the bottom 80% would rise by less than half of one percent.

Unclear expectation: The effect on middle and lower income families. The plan roughly doubles the standard tax deduction but it repeals or reduces current tax deductions that chiefly benefit workers and middle-class people, including mortgage interest, state and local taxes, student loans, medical expenses, moving costs, and tax credits for retired and disabled people.

- The standard deduction will be raised to $24,000 for couples and $12,000 for individuals but the $4,050 personal exemption is eliminated

- The mortgage interest deduction is unchanged for current homeowners, but is capped at $500,000, down from $1 million, for all future mortgages.

- The deduction for state and local income/sales taxes would be eliminated.

- The deduction for state and local property taxes would be capped at $10,000.

The Tax Policy Center (TPC) analyzed the change in after-tax income for the poor, middle class and rich and found the middle class would get a 1.2% boost to their after-tax income and the bottom 40% would get almost no benefit. Their taxes would actually increase $10 to $20, on average, by 2027.

The Center for Budget and Policy Priorities assessed the intent of the plan in its original form when the top tax rate would have been 35%. They estimated the overall results of that plan would be:

- The top 1 percent, who make above $733,000 annually, would see average tax cuts of $90,000 in 2018, increasing their after-tax incomes by 5.9%. They would receive about 45 percent of the total net tax cut.

- The top one-tenth of 1 percent, who make over $3.4 million, would receive average tax cuts of $507,000 in 2018, raising their after-tax incomes by 7.2%.

- This average increase in after-tax income for those in the middle fifth of the income spectrum would be 1.2%.

- The bottom fifth would gain less than 0.5%.

- People with annual incomes over $1 million would receive average tax cuts of $138,000 in 2018, compared to average tax cuts of $270 for households making below $75,000. Millionaires’ after-tax incomes would rise 6.4 percent in 2018, compared to a 0.9 percent increase for those making less than $75,000.

The Joint Committee on Taxation estimated the results of every detail of the plan but we do not need more detail to confirm that its purpose is to benefit the wealthy.

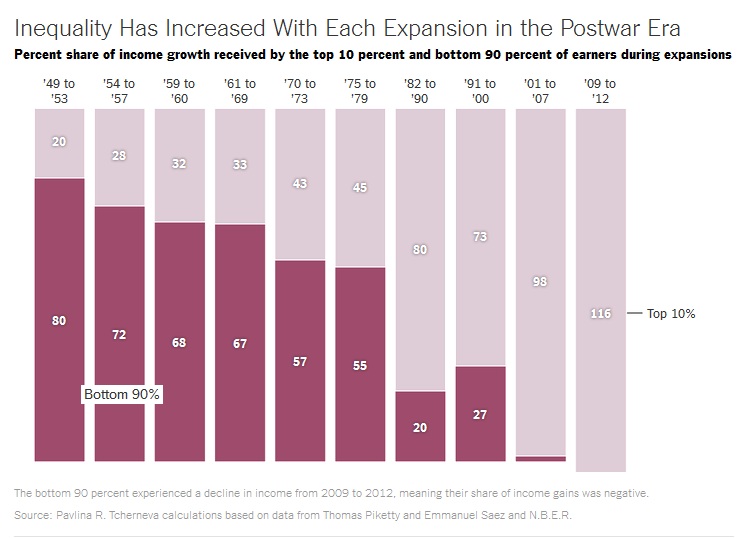

So let’s move on. Is there a way to build on some of the Republican ideas to start reversing our society’s dangerously high inequality?

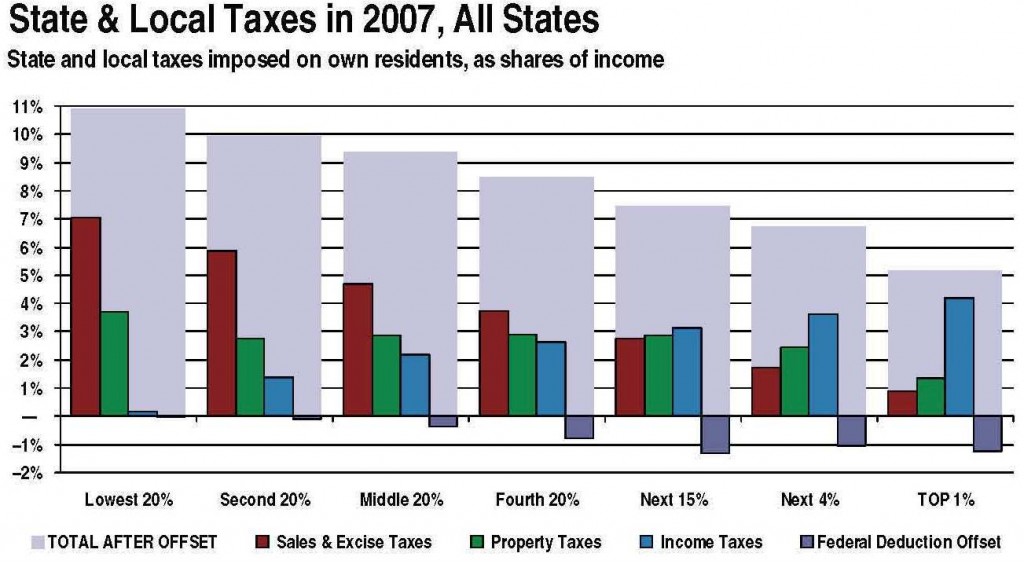

We use tax revenue to pay for services we want from our government. The “we” who want those services is, to coin a phrase, “we the people” not also “we the legal entities such as corporations” so it would be more straightforward to tax the income and wealth only of people.

We could then focus just on the relative contribution each economic subset of people should contribute to the cost of government services that benefit us all. We would still have vigorous disputes about relative contributions but we could better understand each others belief about what is fair.

Making that change might also encourage us to pay more attention to how much our government spends on each of its services.

We know what Social Security and Medicare cost us because we pay for those with dedicated taxes. But most of us do not know that what we spend on our military activities dwarfs every other discretionary service and includes having our troops in 53 out of the 54 nations in Africa.

A better program might look like this:

- Entirely eliminate taxes on businesses and tax only the income their owners derive from them. Replace the lost revenue by:

- Making income tax rates steeply more progressive, perhaps returning to the 1980 70% rate

- Entirely eliminating preferred subcategories of income such as capital gains, pass-through and carried interest. We would tax all income above, say, $12,000 per person, from all sources at the same rates.

- Making the estate tax very steeply progressive on amounts above, say, $5 million (which my grandfather’s generation did to end the stranglehold of Britain’s aristocracy).

Some other things we could consider: If we wanted to accelerate cutting the influence of our financial oligarchy we could also establish a wealth tax, similar to property tax but applied to all wealth.

We could also build on the Republican idea of cutting tax deductions that benefit some people over others. and entirely eliminate tax preferences, including mortgage interest, state and local taxes, student loans, medical expenses, moving costs, and tax credits for retired and disabled people.

We could raise the minimum wage if we believe the Republican theory that eliminating the tax on businesses would cause wages to rise. We might raise them to the level where a head of household could support their family as they did before America needed to be made great again.

We could also explore new taxes such as this one and use those revenues to fund maintenance of the transportation and other infrastructure that we all depend on.

Summing up: The Republican tax proposal contains some good ideas but the way they are structured would greatly benefit the very wealthy and do little or nothing for everyone else. It would also greatly expand our debt whose cost will be born by us and future generations.

The promises made to sell the plan are spurious. It can not be supported by anyone who understands it and is not wealthy and selfish.

But we do need a better tax system. What do you think of the progressive approach above? Don’t worry if it seems impossible. If we are clear on what we want, we can figure out how to get there.