I’m blessed to have friends whose beliefs I do not share. They make it so much easier to see that if I believe this, I cannot also believe that.

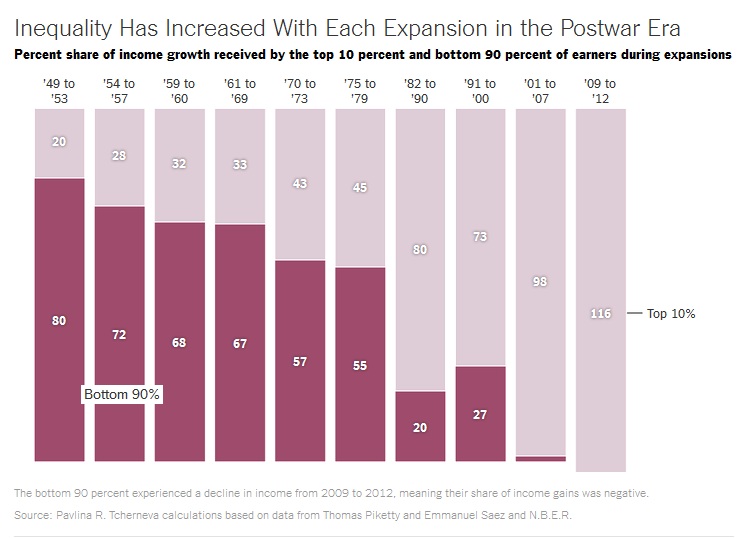

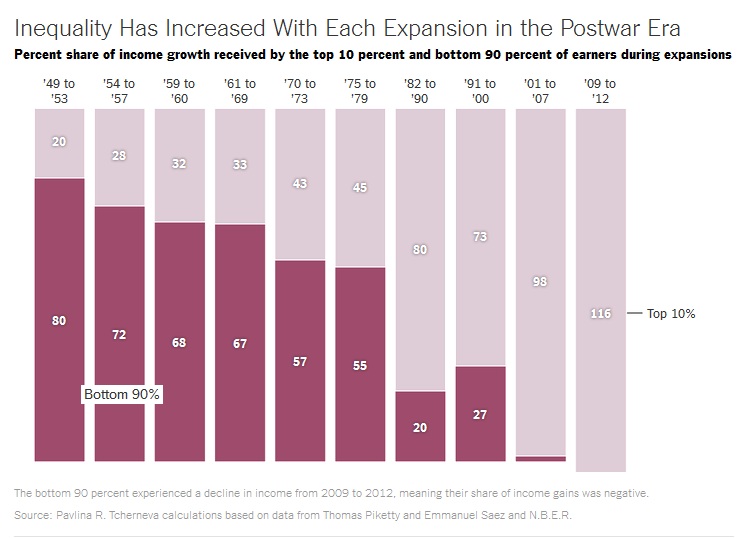

My ideas were well tested in a discussion of this New York Times article about income inequality analyzed in the context of US economic expansions by Ms. Tcherneva, an economist at Bard College.

In the 1940s, ’50s and ’60s, most income gains from the bottom of one recession to the start of the next went to most people, i.e., the bottom 90% got a majority of the increase. But in each expansion they got a smaller share while the top 10% got increasingly more.

From 2001 to 2007, an extraordinary 98% of income gains went to the top 10% of earners.

In the first three years of the current expansion, the incomes of the bottom 90% actually fell, which meant the top 10% got a seemingly impossible 116% of all income gains.

The top 10% now gets almost half of all income. Just the top 3% got almost a third (31%) in 2013 and the next 7% got 17%. The remaining half (52%) is shared by the bottom 90%.

Making life harder for the bottom 20%, they got only 36% of federal transfer payments in 2010, down from 54% in 1979.

The short term result of rising inequality is weak economic demand. The longer term impact is lack of progress in education.

The USA is the only high-income country whose 25-34 year olds are no better educated than its 55-64 year olds. College graduation rates for the poorest increased only 4% from those born in the early 1960s to the early 1980s while the rate for the wealthiest increased by almost 20%.

Upward mobility is very limited without a college degree so high inequality in education results in children of prosperous families tending to stay well-off while children of poor families remain poor.

Ms. Tcherneva focuses on the short term issue, weak demand, and observes that our fiscal policy – lower interest rates to increase demand to create jobs – is not working. She suggests the Federal government focus directly on employment: “The manpower of the poor and the unemployed can be mobilized for the public purpose irrespective of their skill level, which in turn will be upgraded by the very work experience and educational programs that the program would offer.”

When the discussion began, a different version of the income distribution chart by Robert Reich was dismissed as “bull crap.” By the end, we agreed that income distribution really is highly unequal in the US and is growing more so. We further agreed that the trend is unsustainable. We came close to a consensus that if it continues too long, there will be civil strife.

And we ended up agreeing that our economy is undergoing structural change. Off-shoring and automation are eliminating many lower paid jobs. AI software is also replacing many higher paid jobs. Perhaps there simply will not be enough jobs humans can do better/cheaper than intelligent machines and we will in the longer term need a new economic paradigm.

When we discussed solutions for today, we disagreed about whether government should try to alter income distribution, directly create jobs, or do more to govern behavior in markets e.g., with stricter bank regulations. We disagreed about whether government should ever try to influence society in any way e.g., by tax incentives.

And we disagreed if education should be primarily private or public.

Seeking a philosophical basis for our beliefs, we discussed the Constitution’s: “We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, … promote the general Welfare …”, and its section 8, which gives the legislative branch the power “… To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the the common Defence and general Welfare of the United States.”

What, we debated, is the Federal government’s responsibility for “the general welfare” in a capitalist society?

Characteristics of all forms of capitalism include capital accumulation, competitive markets and wage labor. Piketty’s research suggests the rate of return on capital is inevitably higher than the rate of growth of wages. What government action does that suggest? To what extent should government constrain behavior in competitive markets? And is the freedom that comes with wage labor sufficient?

What preceded capitalism was slavery where slaves could not seek a better owner, and feudalism which also kept those at the bottom in place. Capitalism has no such iron-clad constraints. In pursuit of higher wages, a better boss, more interesting or safer work, we can try to get any job at all, anywhere.

Furthermore, capitalism requires property rights and other laws while in slave-owning and feudal societies, laws are the whim of the slave-owner or land-holder.

We did not dispute the ideas in the preamble to the Constitution; that central government must enable us to live in peace under the protection of the law. Hamilton in the Federalist Papers was emphatic about “a more perfect union” and “common defense”. States must not have armies, he wrote, because they would go to war with each other if they did. The nation as a whole must defend itself.

Where we disagreed was on Section 8, about the meaning of “the general welfare” and the Federal government responsibilities it implies.

My thoughts were clarified by the discussion. I believe the central government of any nation is responsible for establishing the infrastructure, broadly defined, that is necessary for the general welfare.

Infrastructure means basic facilities, services, and installations necessary for a society to function, e.g., transportation and communications systems, water and power lines. Infrastructure also includes public institutions such as schools, post offices, and prisons. And it includes protection of “the commons”, things we all need that nobody owns such as the air.

Different combinations of public and private involvement can create and maintain infrastructure, but the central government is always responsible for ensuring that current and future generations will have an infrastructure that enables the nation to remain competitive and viable.

I have long thought, for example, that our central government should lead us from dependency on Middle East (or other) oil by establishing a suitable electricity grid. What struck me in this discussion is that I think a well educated and healthy work force is also part of our infrastructure.

And I want nobody to be prevented from fulfilling their potential by the circumstances into which they are born.

That led me to two conclusions about education. First, it must be funded from the center because if it is not, welfare cannot be general. Some will be privileged by accident of birth while others who may have high intellect and/or other gifts will not get an education that enables them to fulfill their potential. Second, the curriculum must be set at the center because if it is not, our workforce will not have a dependable base of skills.

I do not mean specific work-related skills, almost all of which now have a short shelf-life because technology is advancing so fast. I mean the ability to seek out and recognize facts, to reason from facts to conclusions, and to communicate effectively with people whose ideas are different.

We are not born knowing how to do any of those things or how to act as members of society, just as we are not born knowing how to read or do arithmetic, and that’s important because we can’t have an effective democracy if voters can’t recognize facts or reason from them.

In fact, we do not have an effective democracy, and I want that to change!

My views, taken as a whole, seem to fit no label. I believe, among other things, that:

- Markets should operate as the engine of creative destruction (i.e., I’m a capitalist)

- Which means, for example, that too-big-to-fail financial institutions must be broken into smaller entities that can go bankrupt

- And (almost?) all tax incentives should be eliminated

- Individuals should be held accountable for their actions

- Which means we must strengthen regulation and enforcement of individuals’ behavior in markets (i.e. prosecute criminal behavior)

- Everyone should have a reasonably good opportunity to fulfill their potential (i.e., I’m a progressive)

- Which means we need a progressive income tax code and high inheritance taxes

- And Federally funded education with a uniform national curriculum

- A reasonable amount of health care and etc should be available to all (i.e., I’m a socialist)

- Which means we need a universal single-payer health system

- Infrastructure investment by the central government is necessary and can be funded by borrowing (i.e., I’m not a fiscal hawk)

- But spending programs should be funded with current revenue, i.e., taxes (so maybe I am a fiscal hawk)

- Our misguided spending on wars should be invested productively, e.g., on an electricity grid that helps us overcome our dependency on oil and coal (i.e., I’m a peacenik)

My education left me unable to accept an entire package of ideas from anyone else, but it’s hard to avoid cognitive dissonance when you assemble your own set. It’s almost impossible to spot every inconsistency. This is why I’m so grateful to my diverse friends for helping me see more clearly.