Consumption taxes are among the least harmful for growth but they fall heavily on those with low incomes. Analysis of their fairness must consider their role within an overall tax structure.

Consumption taxes come in several forms. Sales tax is collected by retailers at the point of purchase. Use tax is collected on items purchased outside a taxing authority’s jurisdiction, e.g., a vendor in another state. Excise tax is paid by the producer or wholesaler, e.g., of gasoline or alcohol. Value added tax (VAT) is collected step by step from every buyer in the value chain (see below).

Sales tax: We have no federal sales tax but 45 states levy it at rates ranging from 1% to 10% and many local governments collect an additional amount. What goods and services are taxable varies. Nearly all jurisdictions exempt some categories or tax them at reduced rates. Most exempt food sold in grocery stores, prescription medications, and many agricultural supplies. Raw materials and goods purchased for resale are always exempt.

Use tax: US retailers with no physical presence in a state can ship goods to customers there without collecting that state’s sales tax. Tax payers should in that case pay the tax directly but they often don’t. Because online retail has greatly increased the lost revenue, the Senate recently voted for a Marketplace Fairness Act so states could compel online businesses to collect all applicable taxes.

Excise tax: The US federal government and many states levy excise taxes on a few items, typically ones for which demand is not greatly impacted by income. One does not buy a lot more gasoline, for example, if one’s income grows. That means excise taxes are usually the most regressive. State excise taxes on gasoline, cigarettes and beer take about 1.6% of the income of the poorest families, 0.8% of the income of middle-income families, and 0.07% of the income of the very best-off, which means they are 22 times harder on the poor than the rich.

Value Added Tax: VAT is collected every time an item or its components is sold, e.g., by manufacturer to wholesaler, wholesaler to retailer and retailer to end customer. Each seller pays VAT on the difference between his cost for the product or its components and his revenue from the sale. When he collects VAT from his customers he keeps the VAT he paid on the inputs and remits the difference to the tax authority. That means VAT is like sales tax in that ultimately only the end consumer pays but different in that some of it is collected by every business in the supply chain.

VAT was first introduced in France in 1954. Governments like it because most of the collection cost falls on business and sellers have a direct stake in collecting the tax. Value added taxes have now been adopted by more than 140 countries and provide an estimated 20% of worldwide tax revenue. The US is one of the few to retain conventional sales taxes.

Consumption tax fairness: The OECD research I referenced in Property Tax and Fairness analyzes the impact of different taxes on economic growth. As noted there, property and consumption taxes are among the least harmful for overall economies. They are also, however, the least fair since they fall most heavily on those with a low income although that can be mitigated by exempting “necessary” items, such as food, clothing and medicines and/or by providing Earned Income Tax Credits (EITC).

This Distributional Analysis of the Tax Systems of all 50 States assesses the fairness of every state’s tax system in terms of income groups. “The main finding of this report” it begins, “is that virtually every state’s tax system is fundamentally unfair.” That’s because when all state and local taxes are added up, most states tax wealthier families at a lower rate than low- and middle-income families. Only two tax their wealthiest as much as their poorest and only one taxes its wealthiest at a higher effective rate than its middle-income families. The primary source of unfairness is consumption taxes.

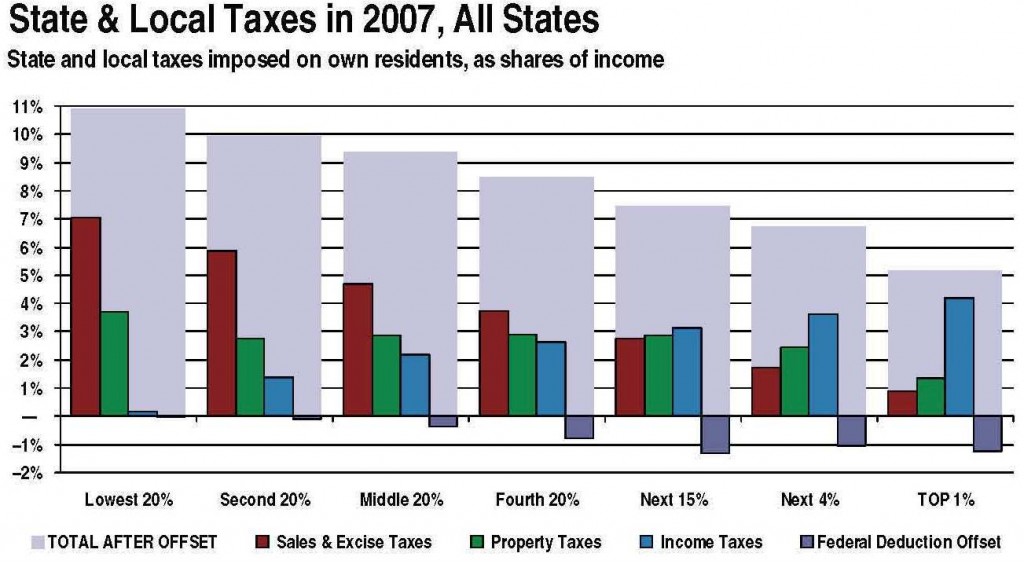

The average combined rate on the best-off 1% of families is 6.4% before federal deductions for state and local taxes. After accounting for that “federal offset”, their effective tax rate is 5.2%. The average rate on families in the middle 20% is 9.7% before the federal offset and 9.4% after. The average for the poorest 20% is 10.9%, more than double the effective rate on the very wealthy.

The average state’s consumption tax structure is equivalent to an income tax with a 7.1% rate for the poor, a 4.7% for the middle class, and a 0.9% for the wealthiest taxpayers.

Property taxes: Also tend to be regressive, but much less so than sales tax. A home represents the lion’s share of the total wealth of average families but only a small share at high income levels. Because property tax usually applies mainly to homes not all assets, it applies to most of the wealth of middle-income families and a smaller share for high-income families. Because the tax on rental property is passed through to renters as higher rent, it represents a much larger share of income for poor families.

Different states have very different tax structures with very different degrees of fairness.

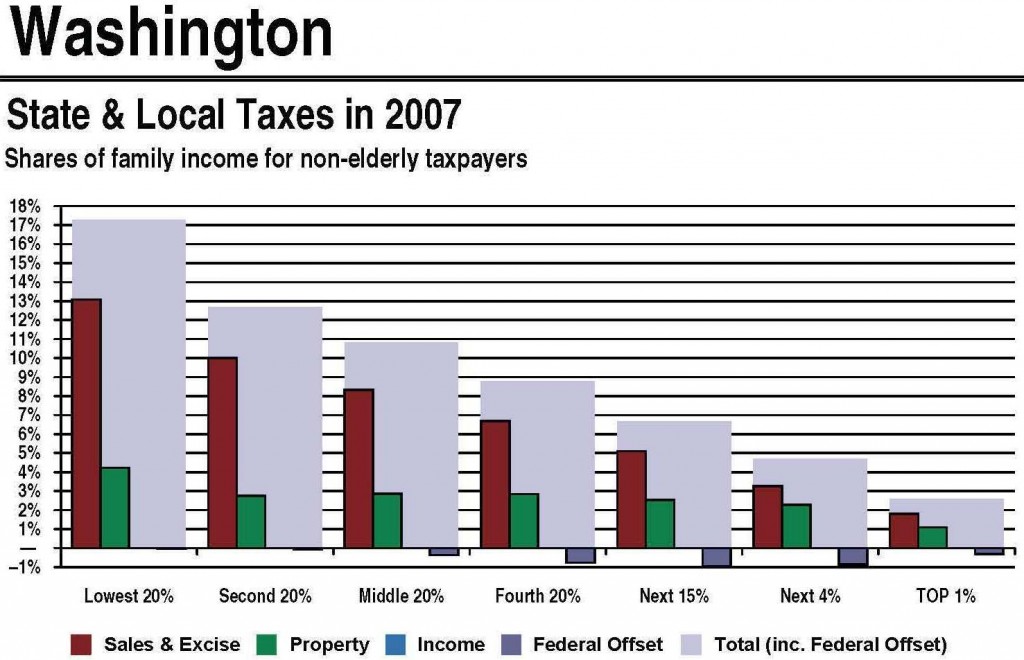

Most regressive tax states: The ten most regressive states collect six times as high a percentage from their poorest 20% as their richest. They either collect no income tax or collect it at the same rate for all income. Washington, the highest-tax state for poor people, taxes its poor families 17.3% of their total income. In neighboring Idaho and Oregon, the poor pay 8.6% and 8.7% of their incomes. Florida, also a no-income-tax state, taxes its poor families at the second highest rate, 13.5%. Illinois, which relies heavily on consumption taxes, ranks third in its taxes on the poor, at 13.0%.

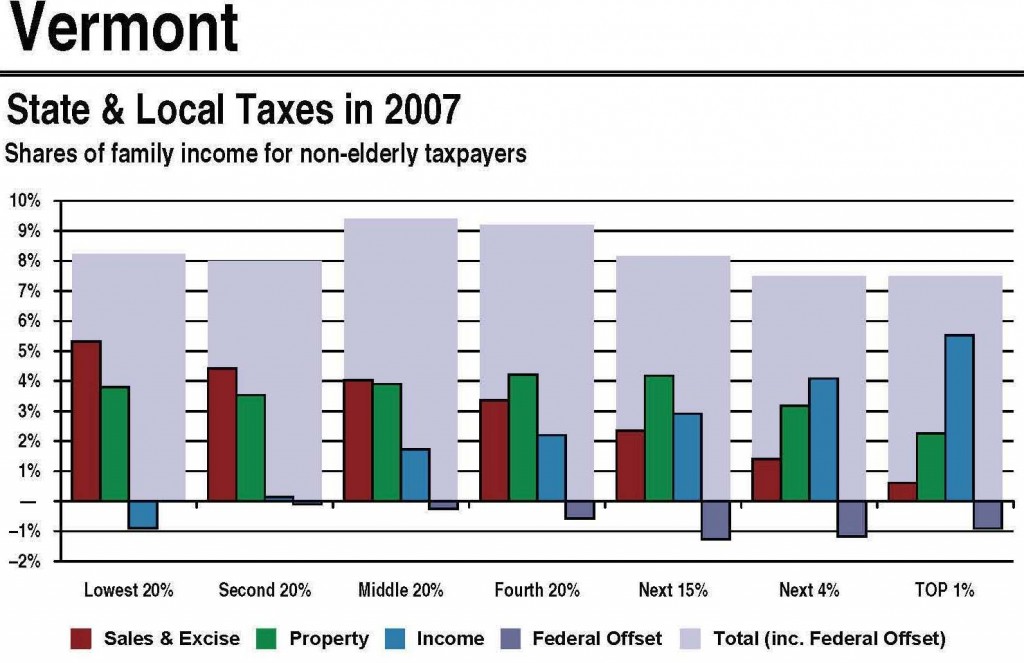

Least regressive tax states: Vermont has a highly progressive income tax, low sales and excise taxes and an Earned Income Tax Credit (EITC). Delaware’s income tax is not very progressive but that is its main source of revenue and its very low consumption taxes result in a system that is only slightly regressive. New York and the District of Columbia achieve a close-to-flat tax system through EITC and income taxes with high top rates.

Conclusion: Consumption taxes are effective but if the tax structure is to be fair, their disproportionate impact on lower income families must be mitigated. Ways that can be done include:

- Progressive income taxes that provide a balance by disproportionately impacting higher income families

- Earned Income Tax Credits (almost a quarter of states use them)

- Exempting necessities, food in particular, that account for a higher part of low income family spending

- Providing essential services such as healthcare at no or low cost because that most benefits those with low incomes

In a future series of posts I will explore services governments can provide and how public spending on them impacts fairness. Next up in this series, everyone’s favorite, personal income tax and fairness.