three French hens, two turtledoves and a partridge in a pear tree.” This old Christmas song was written when the blackbird was food along with the hen, turtledove and partridge. Colly in Old English means ‘black’ hence ‘colliery’ meaning coal mine and colly bird meaning blackbird. Blackbirds were gourmet food in those days. In “Sing a Song of Sixpence” 24 of them are baked in a pie. So here, as thought-provoking fare, are four colly charts.

The first one shows Federal spending, the red line, and revenue (taxes), the blue one, in relation to GDP, the overall economy. Spending is now 24% of GDP, higher than its ~22% average for the past few decades while revenue is substantially lower than spending at 17% of GDP and lower than its ~19% average over the past few decades. This chart illustrates two of our three big problems, too high spending and too low taxes. Our third problem (which I haven’t illustrated because I want only four charts) is economic growth that’s too slow to grow us out of the revenue and spending problems. Slamming on the brakes to fix the deficit would make all three problems worse.

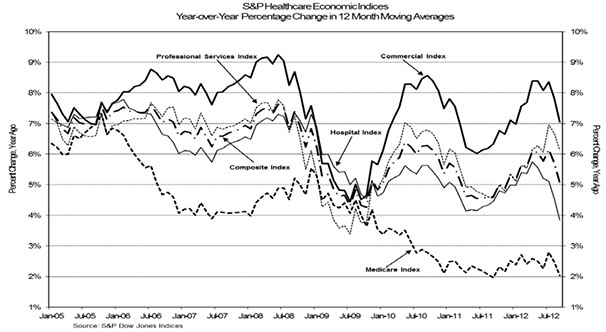

Where to cut spending? Medicare? We keep hearing that’s out of control. The second chart suggests otherwise while also showing that our overall healthcare spending is unsustainable . Medicare spending is now growing at an annual rate of 2%, right around the upper end of forecast GDP growth. It was more than 7% six years ago. Overall healthcare spending, however, (the composite index), which was also increasing 7% then is still growing 6% to 7%, an unaffordable burden on our economy. Cutting Medicare, the only part of our healthcare system that is growing at an affordable rate, would increase that burden.

Where to raise revenue? Wage-earners? The third chart shows that after holding fairly steady at around 65% for the half century following WW2, labor’s share of non-farm business spending has, for more than a decade, been dropping fast. It’s now around 57%. What is correspondingly growing is capital spending. Workers of all kinds are being replaced by computers and robots, not just by lower paid workers in other countries. They, too, are being replaced by technology. Capital investment is especially favorable now because interest rates have been driven so low.

The fourth chart shows that even though low interest rates are attractive to all spenders (especially governments), they are not helping everyone equally. Debt (also interest payments, therefore) as a percentage of income is growing rapidly for those with incomes in the bottom 5%. That’s because their living expenses keep growing but their incomes do not. That will not change for the better in a very slowly growing economy.

Conclusions: (1) Here, too, there is no silver bullet. (2) We’ll shoot ourselves in the foot (at best) if we act as if there is one.