‘Democratic’ in my previous post’s question: “What is the purpose of our democratic society’s tax system?” – means it leads to a fair outcome. That post explores public opinion about tax fairness. But what do we mean by a fair outcome? Taxes are only the means; what about the end, a fair economic structure? We now explore the previous post’s final question: “How should society’s wealth be distributed? What do we actually want?”

Determining how to answer such questions was the life work of US political philosopher John Rawls. His aim was to see how to establish the legitimate use of political power in a democracy; how a society with diverse worldviews can unify for action. He developed a method (the “original position”) to proceed from our deepest ideas about justice to reach real agreement. It works when people imagine themselves entering society in a fair position and answer using only factors their intuition considers fundamental. Phrasing the questions is critically important. Politicians typically phrase them not to promote agreement but amplify differences.

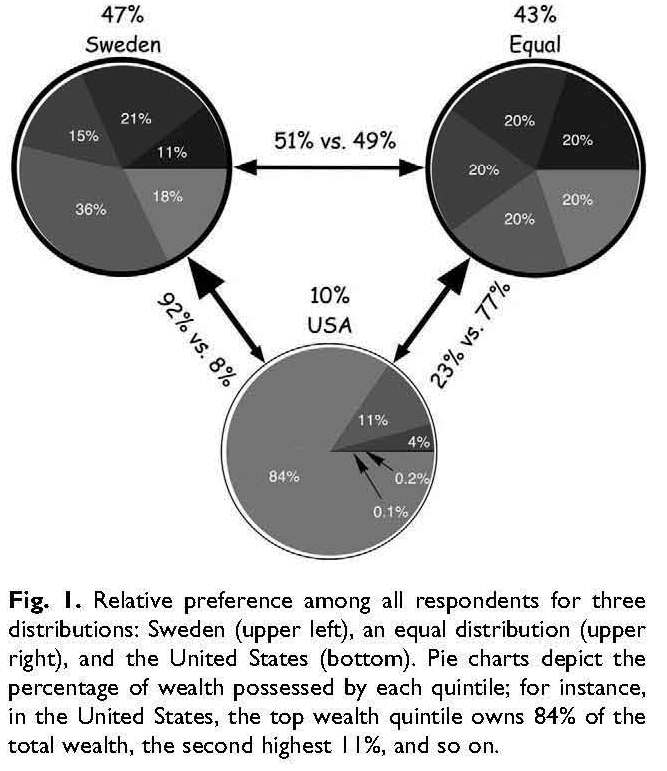

Professors Norton and Ariely used Rawls’ method to survey (see their Report and an Interview with Ariely) a random sample of 5,500 Americans to explore how we want society’s wealth to be distributed. They used pairs of pie charts depicting the distribution of wealth from richest to poorest groups among pairs of nations. They asked respondents which nation of each pair they would rather join: ‘In considering this question, imagine that if you joined this nation, you would be randomly assigned to a place in the distribution, so you could end up anywhere in this distribution, from the very richest to the very poorest.’’

The pie charts shown to respondents were not labeled. One showed the existing distribution of wealth in the USA. One showed all groups having exactly the same. The third showed another real world case, the distribution of income in Sweden. They chose that because it is quite different from the others (income in Sweden is distributed relatively equally but wealth is not).

Presented with the pair of charts representing Sweden and the USA, nine out of ten respondents (92%) preferred the Swedish distribution. The results were consistent across gender, political and economic divides: females 93% vs males 91%, Republicans 90% vs Democrats 93%, income less than $50,000 92% vs $50,001–$100,000 92% vs more than $100,000 89%. There was a slight preference (51% to 49%) for the Sweden distribution over the equal distribution when they were compared directly and a somewhat larger preference when the choices were Sweden or US (92% vs 8%) than when they were equal or US ( 77% to 23%).

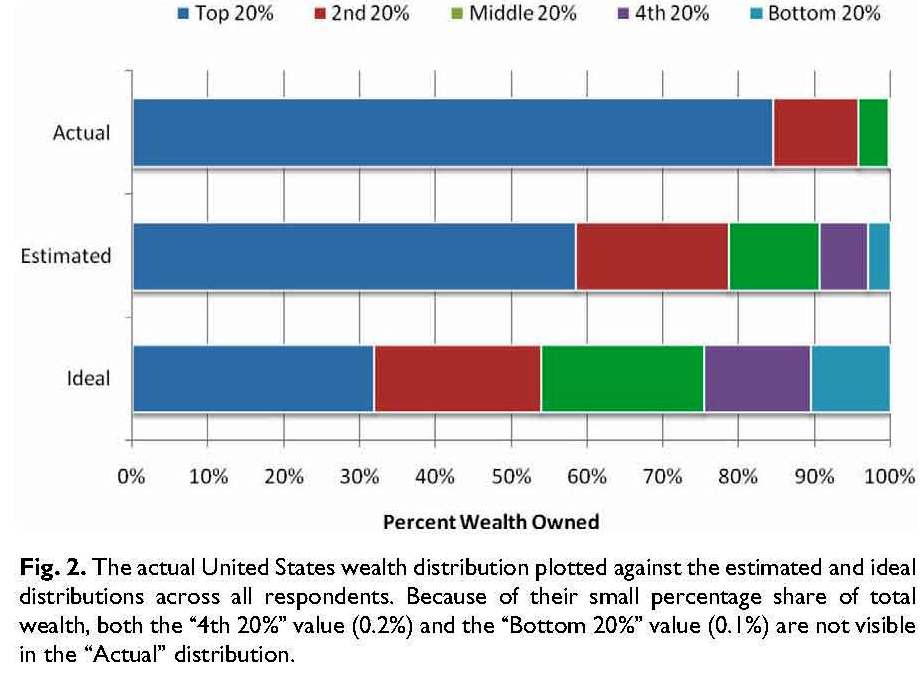

Those answers are provocative; a huge majority of Americans appears to want a society with a relatively equal distribution of wealth. But the question is abstract so Norton and Ariely tested the result. Respondents were next asked what percent of wealth they believe is owned by each of the five economic groups in the United States, and what each ideally should own. They were given the following definition: ‘‘Wealth, also known as net worth, is defined as the total value of everything someone owns minus any debt that he or she owes. A person’s net worth includes his or her bank account savings plus the value of other things such as property, stocks, bonds, art, collections, etc., minus the value of things like loans and mortgages.’’

The second set of answers is equally provocative, is consistent with the first, and is also consistent with my previous post’s findings about clarity. Respondents vastly underestimated the actual level of wealth inequality in the US. They said the wealthiest fifth of Americans holds about 59% of the wealth. They actually have almost 84%. They own fully a quarter more of the total than respondents imagine.

Consistent with the pie chart answers, respondents constructed ideal wealth distributions far more equitable than their estimates of the actual. They want the top fifth to own not 59% of society’s wealth but roughly half that amount, i.e., 32% of the total. They redistributed what they feel is too much from the top fifth to the bottom three, leaving the second group unchanged, making the third about the same as the second, and more than tripling the share of the poorest group. As with the first question, the answers were highly consistent across gender, political and income groups.

So, despite great disagreements over policies that affect wealth distribution, e.g., tax and welfare, a great majority of us appears to believe wealth should be distributed far more equally than we imagine it is, and we imagine it is distributed much more equally than the reality.

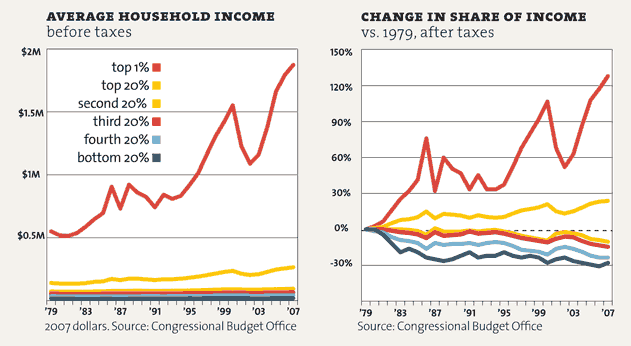

We have extraordinarily mistaken beliefs about the actual level of wealth inequality, and we probably have equally mistaken beliefs about our opportunity to move up in wealth. Incomes of the lower 80% of the population have been dropping for the past three decades. Only the top 1% has seen real growth in income.

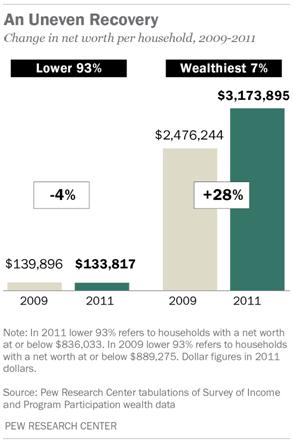

Furthermore, in the most recent three years the wealthiest 7% has enjoyed a 28% increase in their net worth, driven largely by the Fed’s successful efforts to boost the stock market, while the lower 93%, whose primary asset, if they have any at all, is typically the equity in their house, has suffered a further 4% loss in wealth. The Organization for Economic Cooperation and Development (OECD) reports that among all 34 OECD nations, only Turkey, Mexico and Chile distribute their society’s wealth more unequally than we do.

Extreme inequality results when political power based on wealth shapes government policy. That is the norm in autocracies. It can also happen in a democracy. Income inequality in Tsarist Russia was not so severe as ours is now.

Is the relatively equal distribution preferred by Norton and Ariely’s respondents optimal? My guess is we would generate more overall wealth with somewhat greater incentives. That would be good to know but we already do know our existing distribution is far from most Americans want. And history tells us that when income from work goes disproportionately and increasingly to the already wealthy as ours does now, it can only, as my mom always said, end in tears.

I hope we will not wait for a revolution but take democratic action to better distribute the wealth our society generates. I will explore changes to make that more likely in future posts about governance. But first, I will explore changes that would make our tax system better fit its purpose.