Previous posts in this series showed what we tax and who we tax. Now we turn to what makes our tax system so confusing, things we do not tax. These “tax exemptions” include income that’s excluded from taxation, deductions that reduce tax, and payments distributed to people via the tax system.

Tax exemptions are government spending that differs from spending on defense, Social Security or etc only in an accounting sense. As the CBO wrote: “Do you receive a tax deduction for interest paid on your mortgage or taxes to your state and local governments? Would you think about it in the same way if instead of seeing a reduction in taxes the federal government sent you a check for the same amount?” It makes a big difference politically. Tax exemptions are much less visible than spending programs and they generally do not need annual funding decisions.

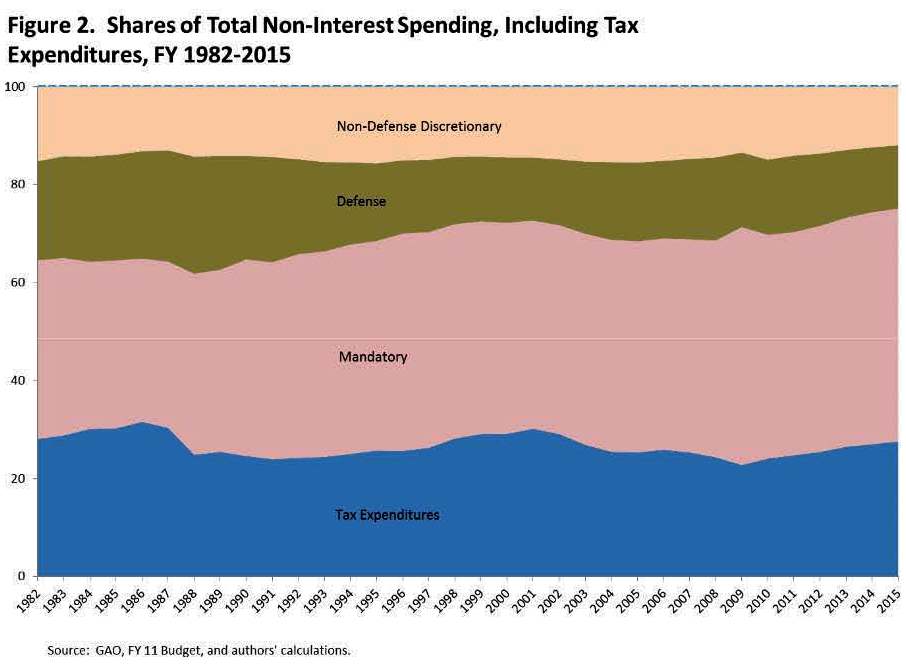

Tax exemptions are a surprisingly large part of all Federal spending, around 30% of the total (see August 2011 National Bureau of Economic Research (NBER) Working Paper 17268 here They are treated differently in the budget process because they are considered to be tax cuts, which makes them less vulnerable to attack than spending. The individual and corporate income tax code now contains almost 200 tax preferences that Treasury estimates result in more than $1T of uncollected potential Federal income tax, more than a quarter of the $4T that is collected.

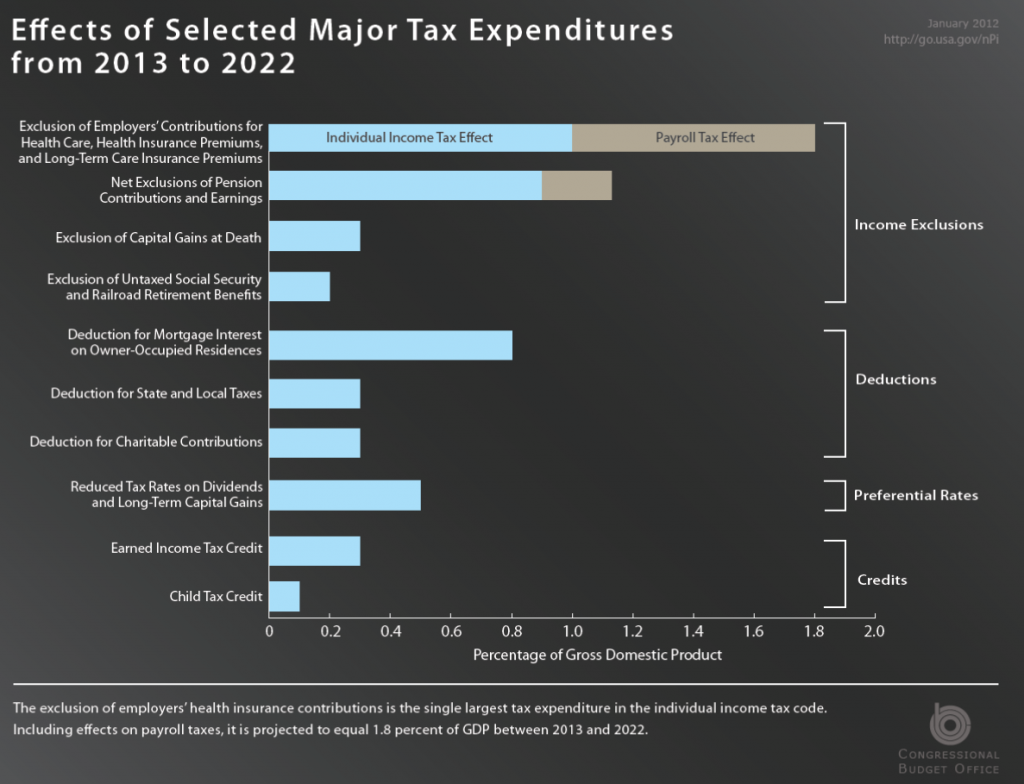

The next chart shows the major tax exemptions. The Joint Committee on Taxation (JCT) and CBO estimates are lower than Treasury’s but still enormous:

- They total more than $800B in 2012. That is more than spending on Social Security, defense, or Medicare.

- They will total nearly $12T in the decade starting in 2013, which is 5.8% of GDP.

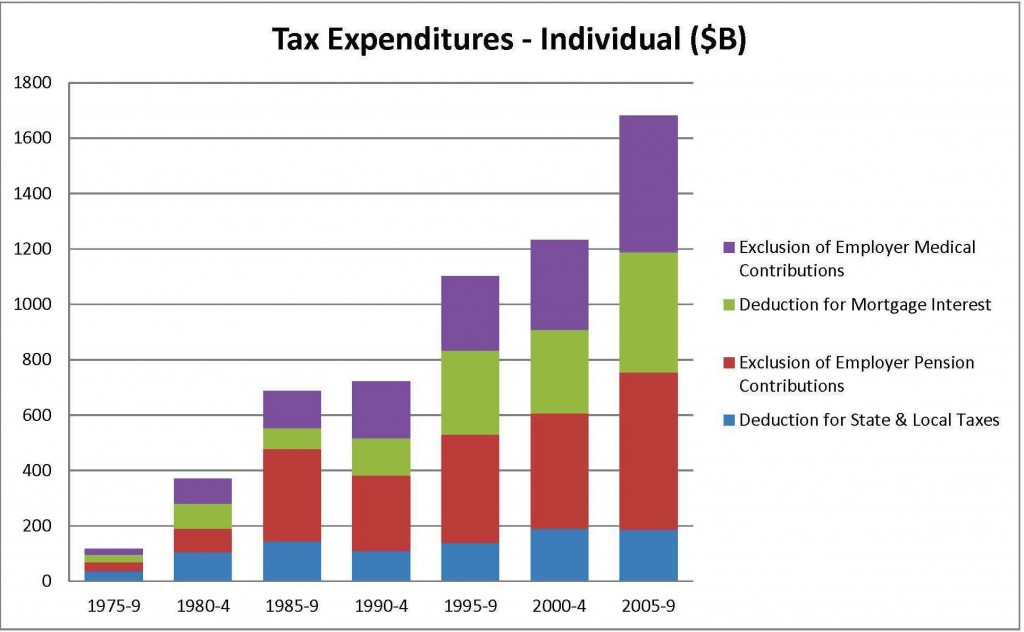

The largest tax expenditure is exclusion of employer contributions for health care. Employees who get this benefit do not pay tax on its value. It is projected to equal 1.8% of GDP over the 2013–2022 period. Next largest is exclusion of pension contributions and earnings, estimated to total 1.1% of GDP over that period, then deduction for interest paid on mortgages projected at 0.8% of GDP, preferential rates on dividends and long-term capital gains at 0.5% of GDP and the earned income tax credit for some low-income workers at 0.3% of GDP between 2013 and 2022. The rate of growth in value of the exemptions differs. The deduction for state and local taxes has remained fairly flat even since 1980-4 while exclusion of employer pension and medical contributions has substantially increased.

Tax expenditures were almost invisible before 1967, when Treasury Assistant Secretary Surrey originated a list of “government spending for favored activities or groups, effected through the tax system rather than through direct grants, loans, or other forms of government assistance”. He wanted to make them visible because tax expenditures have almost exactly the same effects as traditional spending programs on the budget, resource allocation, relative prices, and the distribution of income. Economist David Bradford pointed out that if arms manufacturers got tax credits from the Pentagon instead of cash, that spending would not show up in the Defense budget, tax revenues would fall by the same amount, and yet government would be doing the same thing. Only the accounting would change.

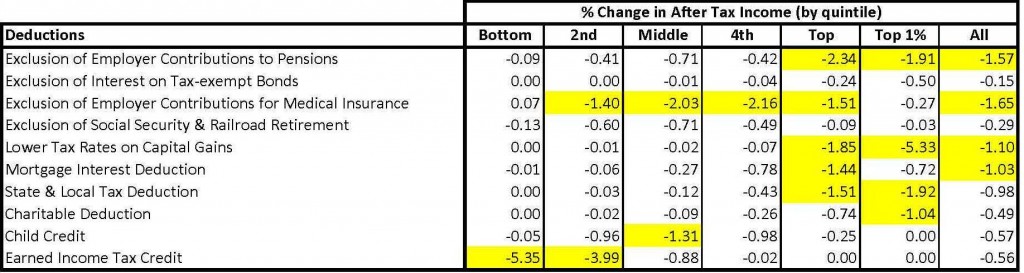

Who benefits from tax exemptions? The following table and charts are drawn from data in the December 2008 Tax Policy Center paper, “How Big Are Total Individual Income Tax Expenditures, and Who Benefits from Them?”

The exclusion of employer contributions to pensions primarily benefits those with the highest incomes. Those in the top 20% of income get an average of 2.34% more after-tax income, for example, than they would without this exclusion. Lower rates on capital gains than ordinary income and deduction of mortgage interest, state and local taxes and charitable contributions also offer most benefit to those with the highest incomes because they have the highest marginal tax rates. All but the bottom 20%, however, get 1.4% to 2.16% more than they would without the exclusion of employer health care contributions. The earned income tax credit (EITC) is the only one that significantly benefits the bottom income group, as it is intended to do.

Only the EITC is overtly aimed at a specific income group. The others are spoken of as if they benefit society in general but they in fact benefit primarily the top 20%. Some disproportionately benefit only those in the top 1% income group. If providing special benefits to the top 1% or 20% was defined as our national policy, it would presumably not be favored by the majority. But the objectives of our tax system are not defined and its special benefits are almost invisible.

The next post in this series will explore business taxes and some ways they can interact with personal tax. That is confusing. Partners in firm’s like Romney’s Bain Capital, for example, get taxed on investment profits at the 20% capital gains rate not the 39.6% top ordinary income rate even if they only manage others’ investments. Executives of large corporations can defer payment of income so it is not taxed in the year it was earned. And so on.

My intent in this and the next post is to give an overall sense of some positive and negative aspects of our current tax system for different income groups and for individual, corporate and other legal entities. These and the two previous posts are background for an exploration of goals we might set for a tax system and the pros and cons of some potential changes.