Colly birds are unexpectedly thought-provoking. Learning that colly comes from the Old English col led me to the history of coal and other energy sources, how power shifts when it’s abused or new technology arrives, and differences between resource-extracting and self-sustaining economies.

Colliery work was very dangerous. Workers who were not killed by mine shaft collapse, flooding, or explosive gas accidents died later from black-lung disease. Mine owners in 19th century British held all the power and invested little in safety. The workers could get no other jobs but they organized as the 20th century approached. They balanced the owners’ power by striking and they got safer conditions. In 1947 all mines were bought by the government. The miners’ and other unions continued to gain power and make more demands via work stoppages that peaked in 1979 when over 29 million working days were lost. In 1984, the miners stopped work for a year. That cost the economy well over $2 billion but the government refused to negotiate and broke the unions’ power. Stoppages were below 2 million working days by 1990. The number of mine workers fell even more precipitously from over 700,000 in the 1940s to around 12,000 in 2002.

So, excessive power was abused first by the mine owners, then the workers’ unions, then government gained the upper hand before re-privatizing the mines. Union leaders got power when the workers were roused to desperate protest, then lost it when coal began to grow scarce and new technology eliminated the miners’ jobs.

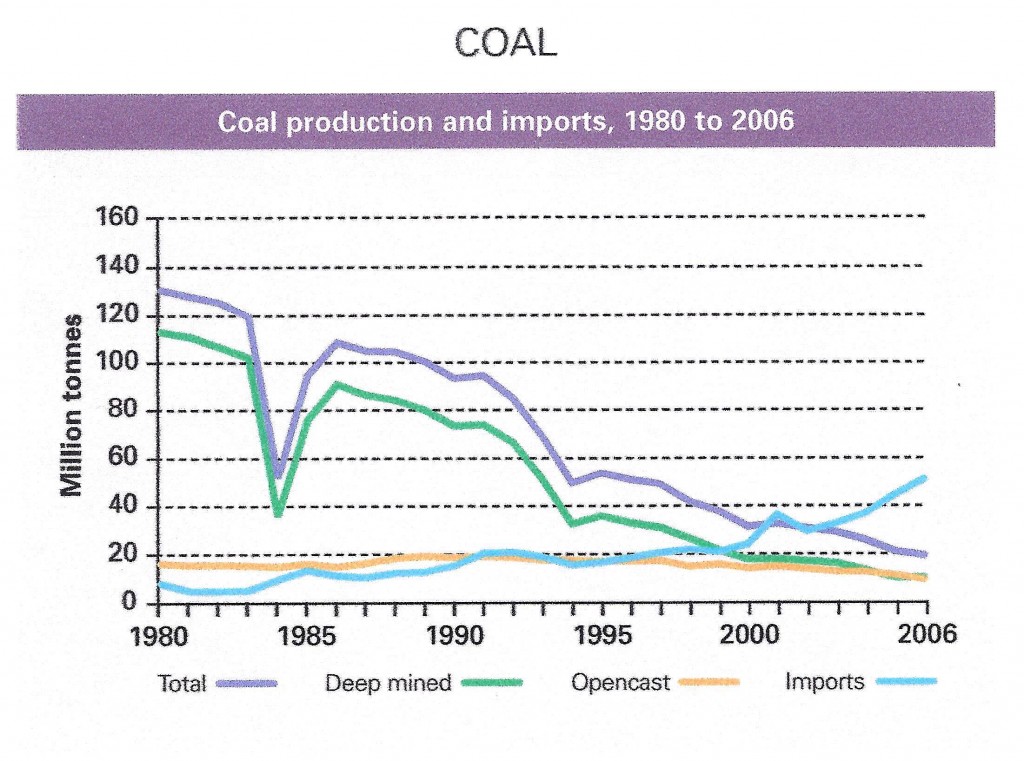

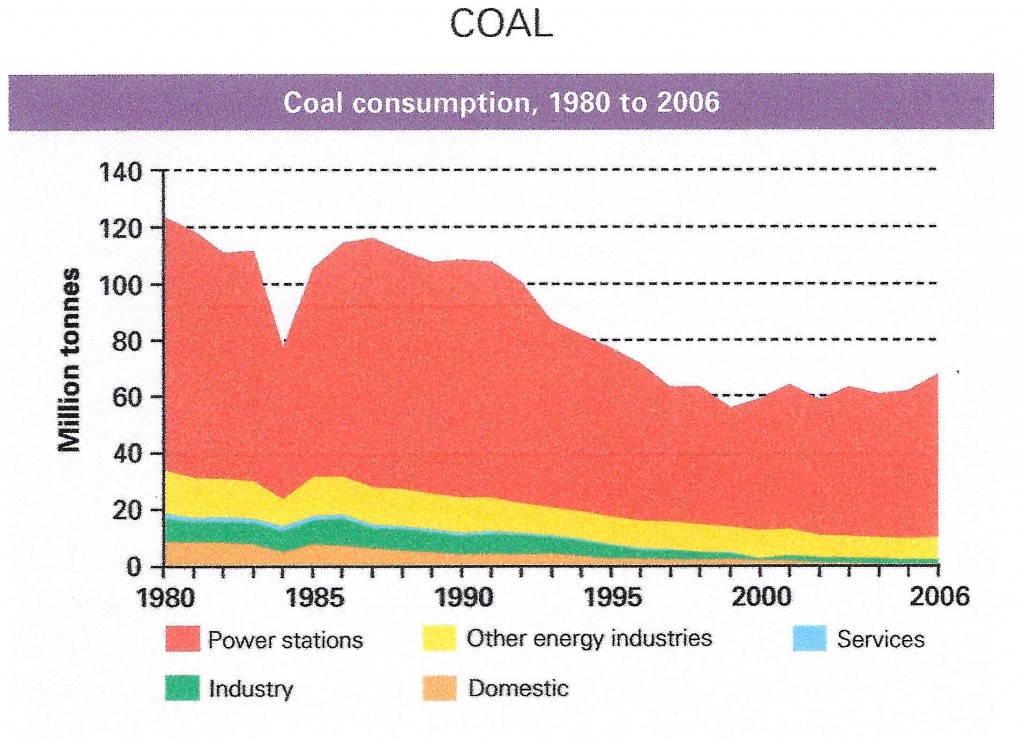

While UK coal production fell from 112 million tonnes in 1980 to 9 in 2006, coal consumption fell only from 123 million tonnes to a low of 59 million in 2000 after which it grew to 67 million in 2006. The growth in demand for coal came from power stations that accounted for 86% of all UK coal consumption by 2006. The drop in UK coal production was balanced by increased imports.

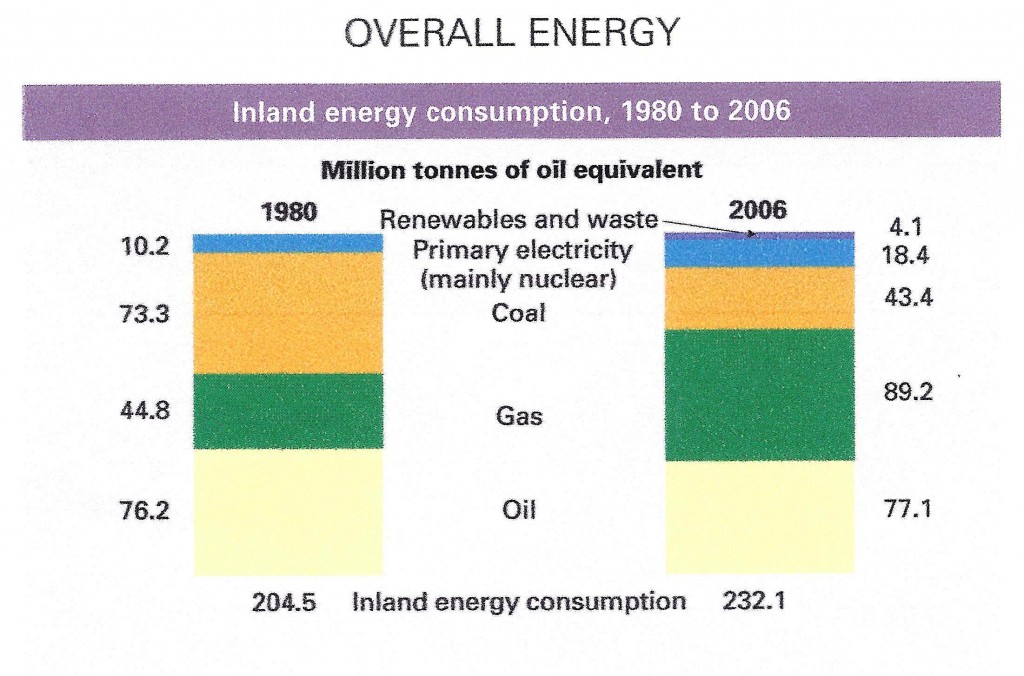

Overall UK energy use grew from 205 to 232 million tonnes of oil equivalent since 1980. Oil use was roughly constant, coal dropped and use of natural gas doubled.

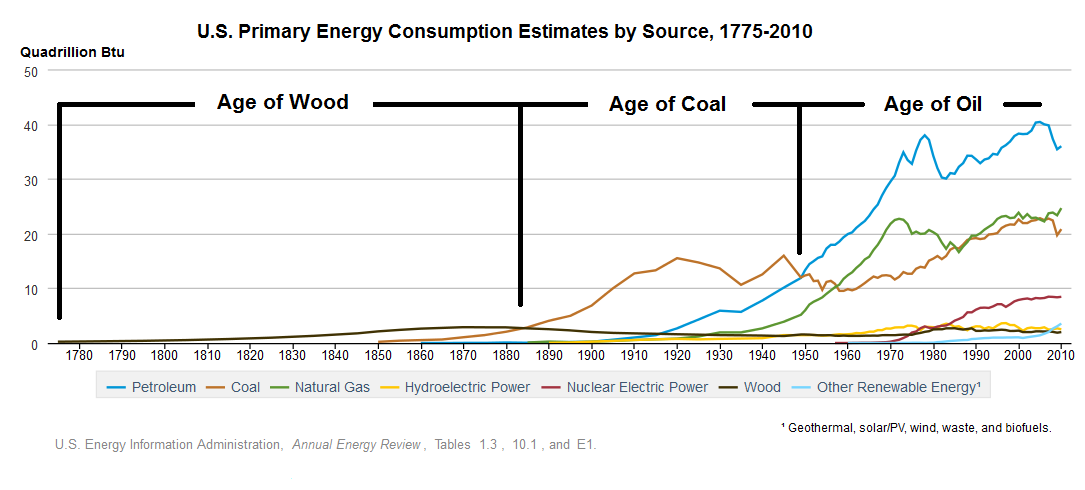

In the USA, where I found longer term data, there is much higher dependence on oil, coal still is as important as natural gas and, as in the UK, although production from renewable sources is increasing, it is still only a small fraction of the total. I’ll return in a future post to energy use and its implications for economies and societies but first, why did I mention the canary?

Canaries were used in British coal mines from 1911 to 1987 as an early warning system. Carbon monoxide, methane and other toxic gases in the mine shaft would kill a canary before affecting the miners. Its signs of distress alerted the miners to escape. It occurred to me that our house was heated by coal when I was a kid and I liked that but I knew nothing about conditions in the mines. Could there be mine-shafts in our economy now where great wealth is being extracted and toxicity is building up? I felt I should take a canary to investigate.

And why colly birds again? Because they and other birds in the song were rich folks’ food. The audience for and singers of the song were being promised those things. We tend to overlook toxic by-products of rich folks’ things because we like to imagine that we, too, could be rich. That makes us vulnerable to contemporary equivalents of the Monty Python pet store salesman who insisted the deceased Norwegian Blue parrot he sold was not dead but resting, pining for the fjords or momentarily stunned, or the 4th century Greek man complaining to a slave-merchant that his new slave died who was told: “When he was with me, he never did any such thing!” Those jokes work because we really are vulnerable to such nonsense.

We should always, but rarely do, consider incentives. To understand a business’ sales results, understand its sales folks’ comp plan. To understand a society, understand the basis of its economy. Resource-extracting endeavors like coal mining encourage owners to make their one-time harvest as fast and profitably as possible. Self-sustaining enterprises like Nepali hill farms that require terraces to be maintained for food this year also enable them to raise crops next year, and their descendants in future years. The different bases of the two economies drive short-term-only or short-and-long-term-optimizing behaviors.

Coal mining and subsistence farming are illustrations. I’m no romantic about village life. My sheep needed care every day; care in bad weather, intensive care in lambing season, care when I was sick, care that must be expert or they would die. It’s hard and stressful work that never ends and sheep die in disasters no matter what. There are much easier ways to support oneself. All I’m saying is we should notice negative side-effects of the way we live and consider if there are better ways.

So, in future posts I will take a canary down some jointly-owned, private-public mine-shafts that are disproportionately rewarding for their owners and harmful to others. Four that seem especially problematic are the:

- Miilitary-industrial mine-shaft that keeps us in a ruinously costly perpetual state of war

- Washington-Big Oil mine-shaft that keeps us in a military trap in the Middle East and keeps climate change off our agenda

- Washington-healthcare industry mineshaft, our largest at 17% of GDP, which costs us twice as much as in any other rich country and makes us the only one without universal healthcare

- Washington-Wall Street one that supplies almost every US Treasury secretary and paved the way for financial crisis, mega-bailouts and not a single prosecution of criminals.

I will also explore the economic and social impact of technology. The UK coal miners who improved their lives by increasing their relative power later lost their livelihood to new machines. New technologies like that can greatly increase capital returns by replacing human labor, which increases unemployment and pushes down wages. That cuts society’s ability to pay for the newly automated products and services, and everything else.

I will try to shed light on how governments can respond to:

- A great imbalance of power in part of the economy

- New technologies that will have disruptive economic and social impact.